“The fashion industry’s current business model is clearly unsustainable, especially with a growing middle-class population and rising levels of consumption across the globe.”

--Environmental Audit Committee, UK House of Commons

With the rapid growth of the fashion market, textile and apparel industry is facing tough challenges, despite having a positive transformation. Global Fashion Agenda published the Status Report of 2020 commitment which focuses on circularity system for a progressive sustainable fashion industry. Similarly, the European Union has set their mission of 2020 focusing on high-tech process of fiber manufacturing to end the era of mass manufacturing of textiles and apparel with the implementation of intelligent and personalized production process. East African nations including Ethiopia and Kenya are expecting to become the next global hub for apparel and textile manufacturing. Eventually, Asian manufactures including Bangladesh and Vietnam will remain the best possible sourcing destination for 2020.

Do you have any idea, how fast is the fashion industry growing?

The global apparel market is growing faster than ever before. Due to the improvement of economic conditions, a significant number of people are rising as middle class. Along with the increased consumption rate, fashion waste has also been increased and fast fashion is one of the most prominent influencers.

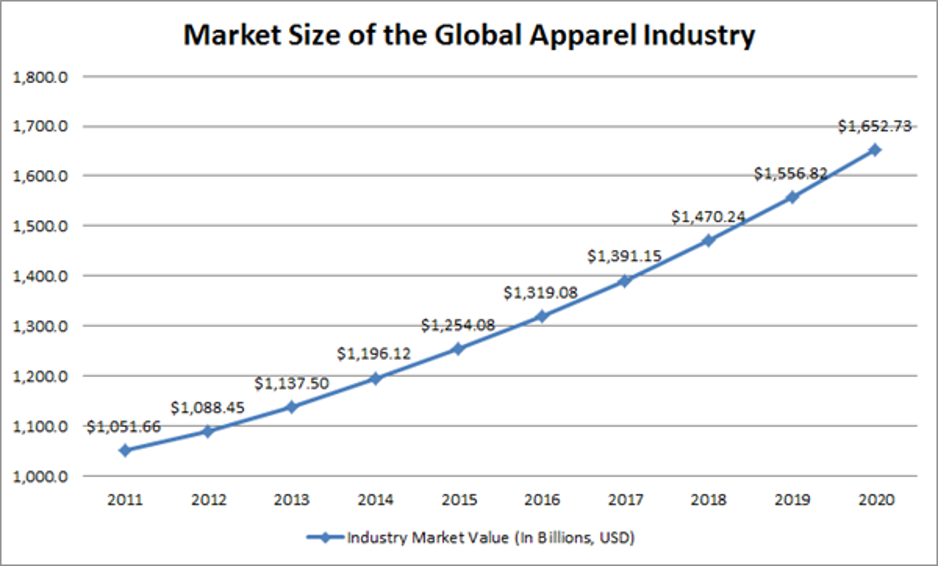

Back in 2011, the market size of the global apparel industry was US$1.05 trillion and it is expected to reach $1.65 trillion by the end of this year. In this time span, the overall growth rate of this industry has been 4.78%. (Source: MarketLine)

According to a report by Ellen MacArthur Foundation, US$1.3 trillion worth of apparels are manufactured annually and more than 40% goes to landfill due to the lack of proper utilization.

Do you know how much water is needed to make a shirt?

2,700 liters of water are needed to make a cotton shirt!

Do you know how much carbon is produced by one pair of Jeans pants?

Manufacturing one pair of jeans produces the same amount of greenhouse gas as driving a car for 69 miles! (Source: Science Friday)

Simply put, the global apparel industry is facing sustainability agenda and Global fashion players are under immense pressure for certain reform in the sector to cut environmental damage. As a result of various ongoing issues, the growth of global fashion industry will slow down further to 3 to 4 percent. (Source: The McKinsey Global Fashion Index)

To improve the situation, digital data system might leverage the technology to reduce environmental damage and meet the sustainability goal set by the environmentalists.

Along with the sustainability challenges, some other obstacles like forced and trafficked labor and diversity are also affecting the market significantly. Ethical manufacturing has been a big issue in the fashion industry as well.

The global fashion industry is critically focused on recycling system than any other option available. International brands are also highly concerned about the existing fashion waste and utilization of those can be a groundbreaking solution for the ongoing global environmental issues.

Despite potential progress, global fashion industry is far from circularity. The fashion industry is moving forward with a goal of sustainability and circularity is the ultimate process toward achieving the goal. As mentioned in the 2020 Commitment Status Report, Shamini Dhana, the CEO of Dhana Inc. rightly said, “To Embrace circulatory is to value people and the planet every step of the way.” To address this issue Chief Sustainability Officer of Global Fashion Agenda Morten Lehman said, “We must urgently address major roadblocks collaboratively to pave the way for a systemic shift towards circularity.”

As the industry is focusing on circularity, recycling is the major point among the solutions and a number of big giants have started taken measure. To embrace circularity system, implementation of design strategies will play a very important role. The status report 2020 has included several other important strategies where sustainable design and reusing are two of the most important initiatives for missions 2020. Thus, the fashion industry is expecting to increase the collection of used garments and footwear by 24%. Similarly, reselling of those collected garments is set to be 13%. Moreover, the industry is also expecting to make garments from the recycled post-consumed textile products up to 13% of the total collected products in 2020. (Source: Global Fashion Agenda)

In 2020, the consumer sentiment of the world’s largest consumer of fashion, North America is also changing with the transformation of the entire industry. The fashion industry in US is being affected because of increasing tariffs which is aided by the strengthening of dollars. Despite being the largest apparel market in the world, America is slowing down as the consumer sentiment weakens.

Despite the slowdown of US fashion market, the North American textile and apparel industry is expecting an average CAGR growth of 3.21% this year. Since North American apparel manufacturers mostly depend on the US market, this region will also have slower growth. North America, being one of the largest players in the global market is expecting to drive most of its profit from the nonwoven fabrics and apparel segment.

On the other hand, China is progressing as world’s largest fashion market this year. Though it is still unclear about the future of China after the CoronaVirus epidemic, but it’s sure that the fashion market will be critically affected. As pointed out in The State of Fashion 2020, US fashion market is slowing down and will remain vulnerable in 2020, while the entire Asia-pacific is expected to have optimistic growth. In the American region, the Latin American market is expected to remain stable especially Brazil and Argentina.

With a longstanding leadership in creativity and innovations, the European Union remains the second-largest textile and apparel manufacturer in the world. Due to a shortage of cheap workforce, Europe is mostly dependent on advance technology for apparel and textile material manufacturing. According to Center for Research and Technology Hellas, Europe’s 2020 mission is to highly focus on changing the concept of commodity and filament fibers to high tech flexible specialty products. The report also assured that the entire platform will be built on 3 pillars.

The mission is to support the global cause of sustainability.

Firstly, Europe is moving towards specialty products with the help of high-tech manufacturing process. The main objective of technological development is to reduce material waste.

Secondly, new textile applications will shape the production process for speed and efficiency. Because this sector is the material provider for almost all industries, smart application is as important as the products itself. Lastly, the Europe’s mission 2020 prefers customized manufacturing process over the existing mass production.

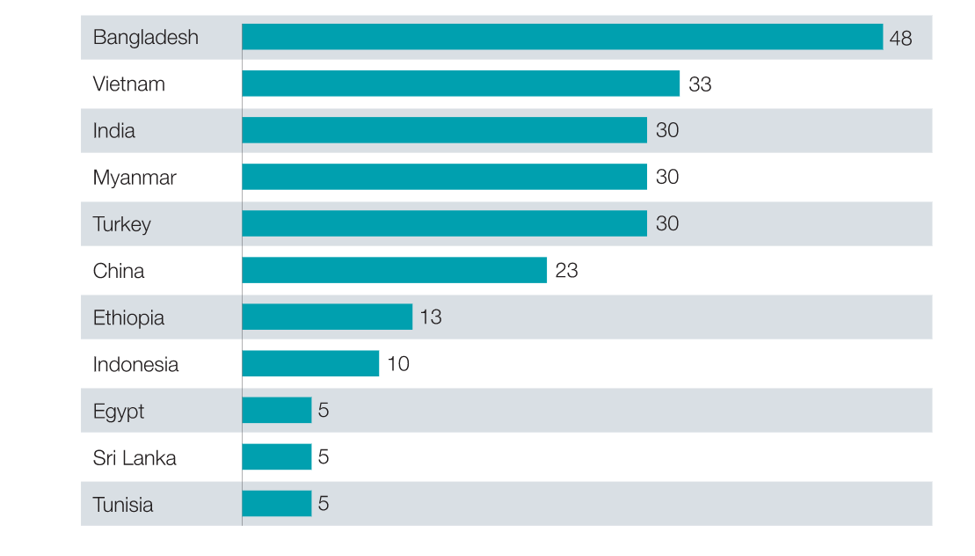

For a couple of decades, the fashion world is very much dependent on Asian apparel and textile manufactures. China has been world’s largest apparel exporter and still holding the mascot. Due to several reasons, the market is shifting from China to some other Asian manufacturers. Bangladesh and Vietnam are two of the largest apparel exporters in the world. According to McKinsey’s Survey of Chief procurement officers, Asian manufactures will remain the center of apparel sourcing for world’s largest brands. The report also mentioned that there is no other nation to beat Bangladesh and Vietnam in the next 10 years.

Source: McKinsey’s Survey of Chief procurement officers

East African nations are progressing with cutting edge technology and expecting to become world’s apparel manufacturing hub in near future. According to McKinsey, East Africa especially, Ethiopia and Kenya are the most potential nations to gain reputation in textile and apparel manufacturing. Because of available resources and lowest labor cost, this region is growth potential zone. A report by The Edge has predicted a growth where Ethiopia and Kenya to overtake present leading apparel manufacturers in future. (Source: The Edge)

The Edge has also reported that Ethiopia has the fastest growing Foreign Direct Investment (FDI) inflow in entire Africa, particularly in the apparel and textile industry. In 2008, investors from USA, China, Germany etc. invested US$109 million and it has grown to US$4 billion till 2019. The Ethiopian government has also set its mission to reach the milestone of US$1 billion textile and apparel export this year. If the present 51% growth is maintained Ethiopia will reach US$30 billion export mark by 2035.

Similarly, Kenya’s garment sector has gained its reputation for high-quality product manufacturing in low cost. Since the beginning, Kenya’s exports have grown quite well. Presently year by year growth stands at average 42% and 18% for knitwear manufacturing. (Source: World Bank)

In response to the climate change issues, the circularity system initiative is a big leap and world’s leading manufacturers are taking initiatives to reduce damage by implementing advance technology. While global fashion industry is moving forward to the circularity system, African nations like Ethiopia and Kenya are expanding apparel and textile industry. On the other hand, China, Bangladesh, and Vietnam will remain the leading apparel exporter for the upcoming decade.